As the dawn of 2024 unfolds, Taxsol New Zealand Limited finds itself at the forefront of navigating the dynamic landscape of tax reforms set to reshape the fiscal framework of the country. With a keen eye on the horizon, we delve into the intricacies of these reforms and their implications for individuals, businesses, and the wider economy.

Income Tax Threshold Adjustments:

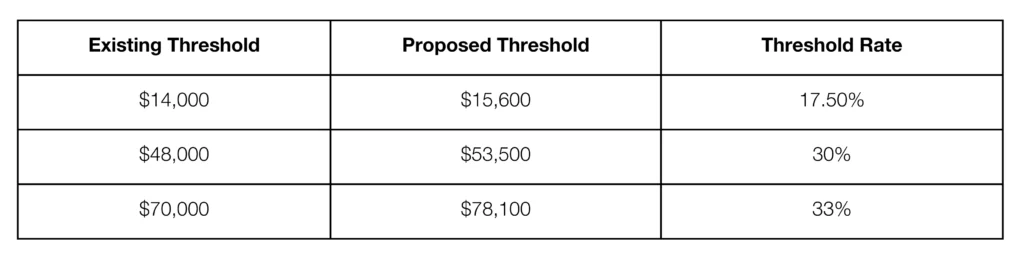

Beginning July 1, 2024, the government intends to enact changes to income tax rate thresholds.

Among these proposed adjustments is the expansion of eligibility for the Independent Tax Earner Credit (IETC) to $70,000, up from the current $48,000 threshold. This move seeks to provide relief and support to a broader spectrum of taxpayers, facilitating a more equitable tax system.

Trust Tax Rate Increase:

In a significant shift in taxation policy, Finance Minister Nicola Willis confirmed an increase in the Trust Tax rate to 39% effective April 1, 2024. This decision, previously proposed by the preceding government, underscores a concerted effort to bolster revenue streams. Furthermore, trusts earning less than $10,000 annually will continue to be taxed at 33%, providing a nuanced approach to taxation within the trust framework.

At Taxsol New Zealand limited, we understand the importance of aligning with regulatory changes. Accordingly, we proactively engage with our clients to ensure compliance with Inland Revenue’s guidance on structural adjustments and transactions affected by the increase in the trustee tax rate.

Interest Deductibility and Bright-line Test:

The phased restoration of interest deductibility for rental properties over the next two years marks a pivotal shift in property investment taxation. With 80% deductibility in the 2024/2025 income year and full deductibility from April 1, 2025, taxpayers will witness tangible relief in their investment endeavors.

Additionally, the reduction of the Bright-line test for investment properties to two years, effective July 1, 2024, heralds a recalibration of property investment strategies.

Commercial Building Depreciation:

Amidst the evolving landscape, the removal of the ability to claim depreciation on commercial buildings, expected to take effect from April 1, 2024, poses challenges for stakeholders in the commercial real estate sector. Taxsol New Zealand limited remains committed to assisting clients in navigating these changes, providing strategic insights and tailored solutions to mitigate potential impacts.

Conclusion:

As Taxsol New Zealand Limited guides individuals, businesses, and stakeholders through the maze of tax reforms in 2024, understanding the implications of these changes becomes paramount. With our expertise and proactive approach, we empower our clients to navigate these changes seamlessly, ensuring compliance and strategic fiscal management in the year ahead.